Luxury Tax Feminine Hygiene Products 2022

January 2022 Newsmakers of the Year.

Luxury tax feminine hygiene products 2022. Feminine Hygiene Products Market is expected to garner 427 billion by 2022 registering a CAGR of 61 during the forecast period 2016-2022. The state collects about 7. Some progress has been made toward addressing period poverty both domestically and.

Get more information on this report. It would not exempt the products. Tampon Tax Repeal 2-Year Registration.

On average women spend a whopping 4800 dollars on period products in their lifetime. Kenya was the first country to abolish a tampon tax in 2004. The term tampon tax is not an official designation but instead a popular term used to call attention to the issue.

But its long treated tampons and similar products as luxury goods. Heres who Austin FC will face in 2022 Video. The Missouri Legislature has proposed a few bills throughout the years that would eliminate the sales tax for feminine hygiene products tampons pads and cups.

In response to an ongoing conflict concerning womens hygiene products Michigan Governor Gretchen Whitmer signed a bill on November 4th 2021 to end taxes on tampons and other feminine hygiene products. State funding in the latest budget aimed to eliminate that. Feminine hygiene products in the state of Missouri are taxed as luxury items which are taxed at 425.

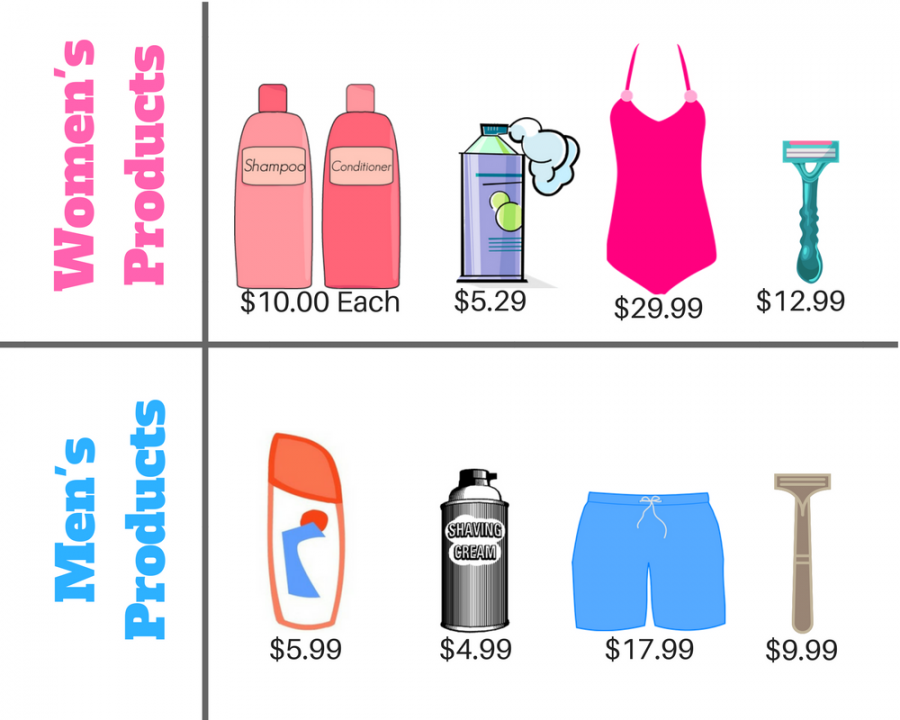

LANSING Michigan women and their families would no longer have to pay sales tax on tampons and other feminine hygiene products under bipartisan legislation heading to Gov. According to Investopedia pink tax is a price discrepancy in which services and. Tampon tax or period tax is a value-added tax or sales tax charged on tampons and other feminine hygiene products while other products considered basic necessities are granted tax exemption status.

For the past few years Missouri has been trying to get rid of the tampon tax. Levy sales tax on menstrual hygiene products such as pads and tampons. While many local jails already offered feminine hygiene products for free at some cost was a barrier.

Their bill would include various types of feminine hygiene products as well as diapers for babies and adults and would only apply to the states 29 sales tax. But not over-the-counter drugs from its 6 percent sales tax. WLUC - Soon Michiganders will not have to pay a tax on essential feminine hygiene products.

Gretchen Whitmer signed the first of two bills that will repeal sales. According to Research and Markets the feminine hygiene products market was valued at Rs 3266 billion in 2020 and is expected to reach Rs 7020 billion by 2025. Feminine hygiene products are not a luxury item.

Ana-Maria Ramos D-Richardson this week the cost of menstrual products was just one topic. Michiganders wont have to pay some taxes on feminine hygiene products and will be able to start buying booze at Michigan International Speedway again in 2022 thanks to some laws that take effect next year. Feminine Hygiene Products Market.

The law will reduce state sales and use tax revenue by roughly 63 million a year a sliver of Michigans 11 billion in. While the Michigan Legislature typically ensures bills that it enacts take effect right away occasionally theres a delay for a variety of reasons. During a Texas Menstrual Equity Coalition Facebook Live discussion hosted by Texas State Rep.

As of 2021 30 state governments in the US. Supporters of the new law said feminine hygiene products are a necessity not a luxury and should be exempt from taxation like other medically. MI Laws Set For 2022 - Across Michigan MI - House Bill 5267 is a bill that stops the taxation of feminine hygiene products in Michigan.

In September 2020 one estimate had the global feminine hygiene products market growing to 51 billion by 2027. Given the cost of menstrual. About 15 states with sales taxes do not tax menstrual hygiene products.

On top of the high prices on period products there is also a pink tax on feminine hygiene products.