Is There A Luxury Tax On Tampons 2022

Following Brexit complications this amendment will be implemented by 2022 at the very latest.

Is there a luxury tax on tampons 2022. Both are taxed as luxury non-essential items you are quite. By March we made history when Parliament accepted a tampon-tax-ending amendment proposed by the amazing Paula Sherriff MP. The Chancellor announced that the tampon tax was to be abolished from 1 January 2021 at March 2020 Budget.

Tampons pads and other menstruation products are considered luxury items. Rank Team Roster 40-Man Payroll Retained Luxury Tax Payroll Luxury Tax Space Luxury Tax Bill. If approved the luxury tax will be imposed on items supplied or imported on or after January 1 2022.

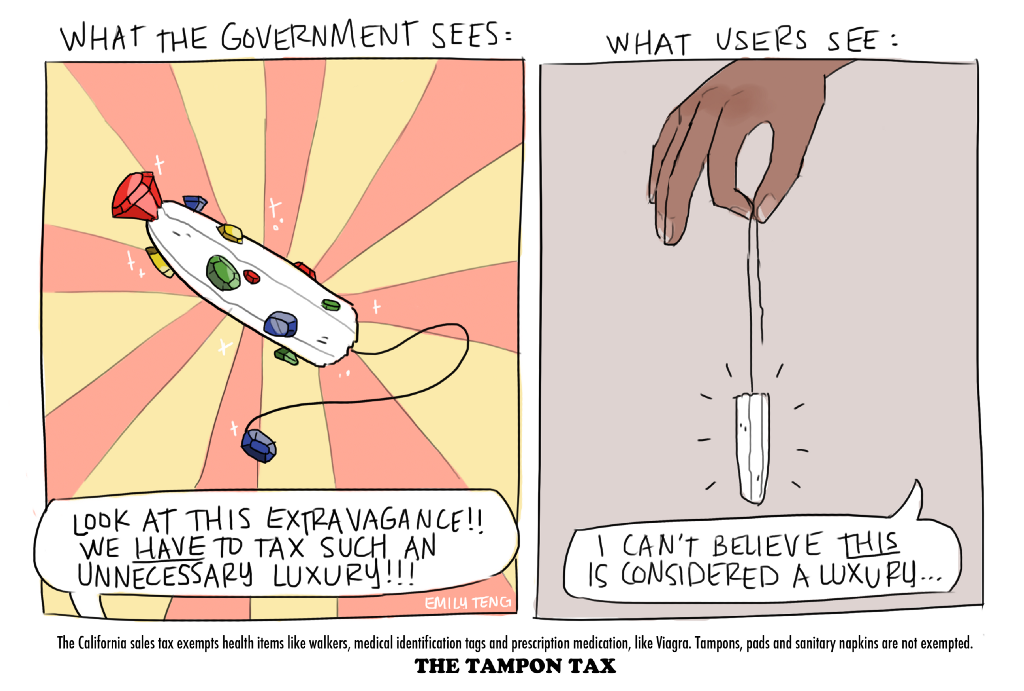

Brushing over the fact that many people also use sanitary towels at the same time as tampons five per cent of this cost is tax. The current Luxury Tax Threshold is 210000000. But its long treated tampons and similar products as luxury goods.

If this Luxury Tax liability is paid by the person in relation to a specified aircraft or specified boat for which there is no tax-paid certificate the person would be permitted to request a tax-paid certificate from the CRA for that specified aircraft or specified boat for information regarding tax-paid certificates see the discussion below under Specified Aircraft Priced over. The Namibian government eliminated VAT on sanitary products also known as the tampon tax on March 17. This state still has a period tax.

The goal is to have a tampon tax-free country by April 2021. Under this law items like chocolate pizza pockets contacts and incontinence items fall under this category and are therefore not taxed. If the legislation passes into law the tax will apply to luxury goods delivered or imported on or after Jan.

Michigan exempts medical supplies but not over-the-counter drugs from its 6 percent sales tax. Women and girls in Namibia will no longer be charged a luxury tax rate of 15 of value-added tax VAT on sanitary products. Currently 30 out of 50 states still have a tax on tampons and other essential feminine hygiene products.

In 32 states womens hygiene products like tampons menstrual cups and sanitary pads are subject to a luxury tax which is placed on products or services that are deemed to be non-essential or unneeded. Registration will be required before the first. As the transition period ended on December 31st the UK is no longer bound by the EU VAT.

However if the vendor of the luxury good and the non-registered person entered into a bona fide written agreement for the sale of the luxury good prior to April 20 2021 the tax will not apply. Currently tampons sanitary pads and menstrual cups are categorised as non-essential luxury goods and have 5 percent VAT value-added tax added to their price. The Treasury vowed to axe the outdated and overtly sexist tax on tampons sanitary pads and mooncups in January 2016.

Luxury car tax LCT is a tax on cars with a GST-inclusive value above the LCT threshold. This state doesnt have a sales tax so theres no period tax either. A real-time look at the 2022 tax totals for each MLB team.

Pads and tampons as well as items like heating pads are tax-exempt in New Jersey. The Democratic governor cited fiscal concerns over his decision to block the bipartisan bill. These figures derive from a players tax payroll salary.

There is currently a minimum VAT of 5 throughout the European Union. Cash Payrolls Luxury Tax Payrolls. Prior to the initial importation or delivery of a luxury good registration.

In many countries however the sales tax on menstrual products cannot be abolished so easily. According to a BBC article the VAT value-added tax on tampons and sanitary towels used to be 175 before it was dropped to 5. Advocates have decried the tax as an unfair burden on women since tampons are not considered a luxury.

However the tax will not apply to luxury goods if the vendor of the luxury good and the non-registered person entered into a bona fide agreement in writing for the sale of the luxury good prior to April 20 2021. That is an obscene amount of. LCT is imposed at the rate of 33 on the amount above the luxury car threshold.

LCT is paid by businesses that sell or import luxury cars dealers and also by individuals who import luxury cars.